Bank Stocks May Face Further Declines in 2019

To say the bank stocks have been a major disappoint in 2018 is a massive understatement. The group has not only been disappointing it has been nearly disastrous with as measured by the Financial Select Sector SPDR (XLF) which is now 12% off its 2018 highs double the S&P 500’s drop as of November 26. The bad news is that outlook for financials stock may get even worse in 2019 to due valuation and signs that yield curve may flatten further or possibly invert. It makes now an ideal time to either exit or even short big money center banks such as JPMorgan Chase & Co. (JPM), Bank of America Corp. (BAC), and Citigroup, Inc. (C)

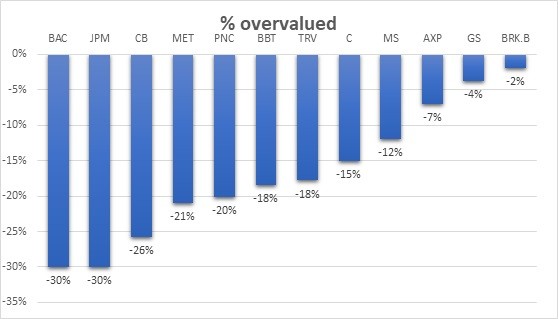

There had been a lot of optimism banks stock would rise sharply in 2018 driven by significant share repurchases and a steeper yield curve driven by strong economic growth leading to a rise in inflation. Instead, the opposite has happened, the yield curve has flattened dramatically, and buybacks have been offset by stagnating revenue growth and slowing earnings growth. Based on present valuation, stocks such as JPMorgan and Bank of America may be as much 30% overvalued should their valuation return to their historical norms.

Warnings Signs

There are signs of a global economic slowdown beginning to take hold. It makes the financial stocks a lousy bet for 2019. Slowing economic growth will lead to lower inflation rates which will pressure long-term interest rate and flatten the yield curve. The curve has already contracted significantly in 2018 in the US with the spread between 10-year and 2-year contracting to its lowest levels in a decade at just 25 basis points. This contraction is being caused by an overly aggressive Federal Reserve which is raising short-term interest rates. Meanwhile, long-term rates in the US are being held down by low inflation rates and low-interest rates abroad. Additionally, there are signs in the US that inflation rates are slowing based on measures such as the producer and consumer price indexes and declining commodity prices.

Inflation rates as measured by the producer price index and consumer price index have been stagnating since November 2017. The producer price index peaked around 3.4% in July 2017 and had declined to 2.9% through October. The consumer price index has also seen a significant slowdown after peaking at 2.9% in August and has since dropped to 2.3%

Weak Commodities

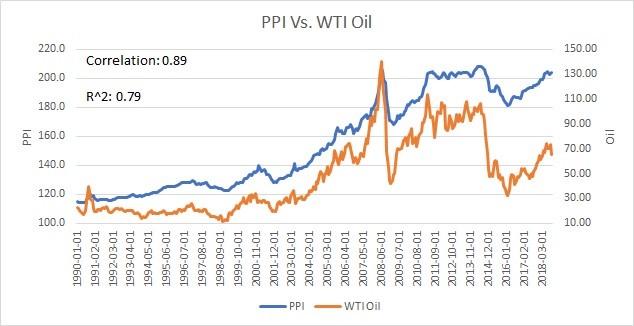

One of the leading indicators for the PPI is the price of West Texas Intermediate Crude Oil, which correlates with the index of 0.89 with an R^2 of 0.79 since 1990, meaning they have a high correlation. It would suggest that inflation rates in November are likely to fall dramatically. Since October 29, the price of oil has dropped by 34% and is at its lowest price since early October 2017.

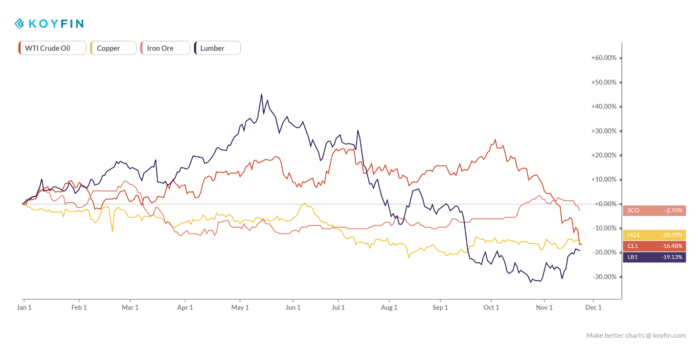

Other crucial commodities used in construction have fallen dramatically this year as well with Lumber prices down 19% and copper falling nearly 15%. Iron-ore a key ingredient to creating steel has fallen 3%. These are not signs of a roaring global economy.

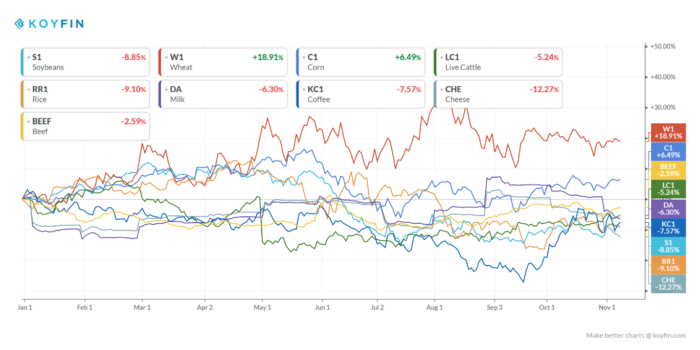

Even when looking at soft commodities, except for Wheat, most major commodities prices are lower on the year. Commodities such as cattle, milk, coffee, soybeans, rice, and cheese are all down by 5% or more this year.

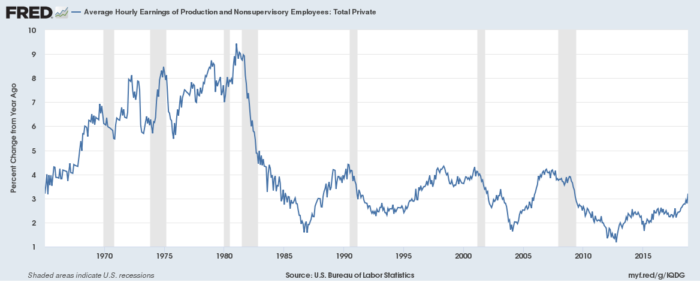

Weak Wage Growth

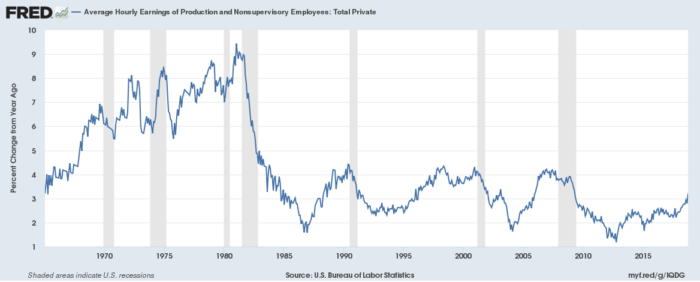

While some will argue that rising wages are an inflationary force, which they are, today wage growth rates pale in comparison to the previous economic cycle. At the peak of the cycle in June 1990, the average hourly earnings of production and nonsupervisory employees rose 4.4%, in Dec. 2000 it peaked at 4.3%, and in Dec. 2006 wages growth reached 4.2%. Today wages are growing at 3.2%. It would suggest that wage inflation is still depressed and needs further expansion.

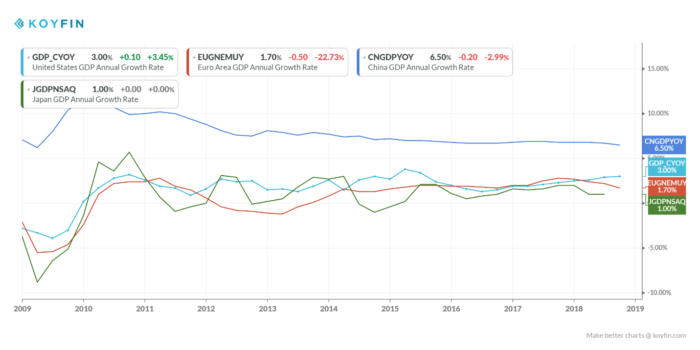

Slowing GDP Growth

Additional global economic growth is now showing signs of slowing as well. Euro Zone GDP growth has slowed for five quarters in a row and has fallen to just 1.7%. China GDP growth has slowed to its weakest pace in a decade to 6.5%. Meanwhile, Japan has slowed from 2% growth to just 1%. The US is still the only economy showing steady growth with nine consecutive quarters of faster growth.

The fascinating piece of information is that eurozone growth is now growing at the same pace as is in 2015 and 2016 when the ECB instituted negative interest rate policy and quantitative easing, but now the central bank is about to end QE.

Lower Inflation rates

It all points to lower inflation rates and perhaps slower economic growth which suggests lower, not higher, long-term interest rates. Should rates on the long-end of the curve fall that will, in turn, be a negative development for US financial institutions, as the US yield curve potentially inverts. At this point, the spread between the US 3-month Treasury bill and the 10-year Treasury 65 basis point. Should the Fed continue on its course for one more rate in December and 3 in 2019, the yield curve will invert by June of 2019.

Bad News for Banks

The lower interest rate environment is something that could be detrimental to the bank stocks and would be negative for the interest income they generate. It would always cause the big money center stocks to decline further.

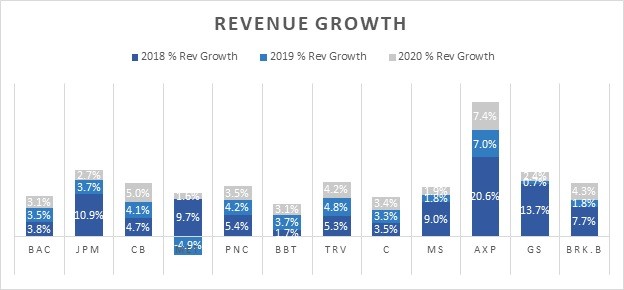

Slowing Growth

Many of the banks are already expected to see significant earnings and revenue slowdowns in 2019 and 2020. Should yields curve flatten further, or global growth slow faster, then those growth rates will fall even more.

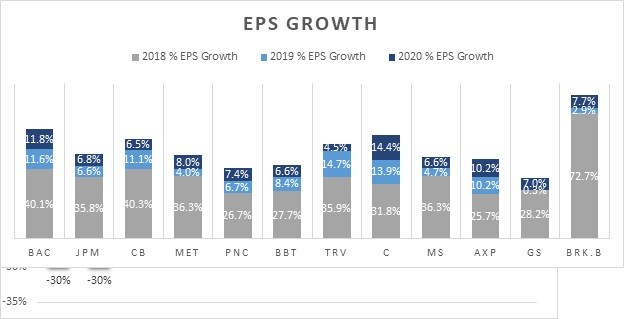

Overvalued

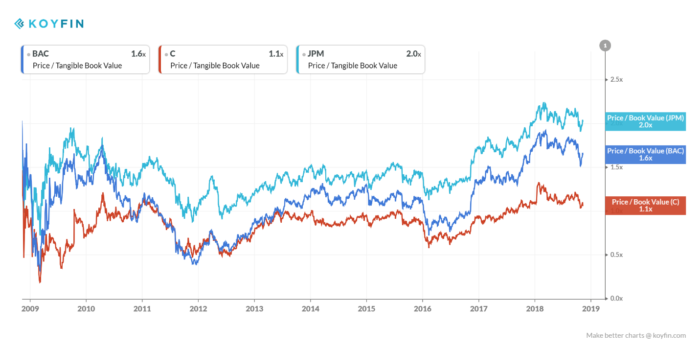

One of the most glaring observation is that the banks such as JPMorgan, Bank of America, and Citigroup are trading at nearly their highest price to tangible book values in a decade. These valuations come despite the steep declines already seen in these stocks.

JPMorgan

JPMorgan is the most overvalued bank trading with a price to tangible book value of 2.09 versus its 7-year median of 1.46. With a tangible book value per share of $53.07, should JPMorgan revert to its median, the stock price would fall 30% to about $78 per share.

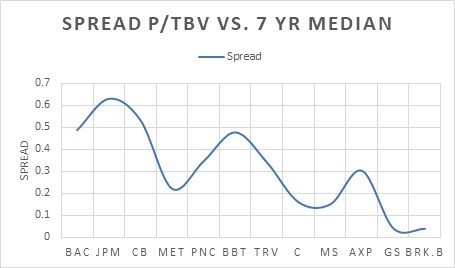

Many of the financial stocks are trading well above their 7-year median price to tangible book value.

It leaves many of the banks trading at extremely overvalued levels, and that would suggest even further declines for many of these stocks. Not surprisingly, the big money center banks are the most grossly overvalued, Bank of America and JPMorgan.

It makes exiting positions in banks such as Bank of America, JPMorgan, PNC Financials, and Citigroup leading candidate. One may even consider shorting these banks should the yield curve continue to flatten and the Fed shows no sign of slowings its pace of rate hikes, or global growth slows further.

Biggest Risk to Thesis

The biggest risk to the bearish outlook for this sector would be if the Federal Reserve took a more dovish tone going forward. Should the Fed slow its pace of raising rates, then it may allow the yield curve to rotate from flattening to steeping which would be bullish for the banks.

Additionally, should signs of the global economy begin to improve or commodity prices begin to rise it too would be a bullish indication for bank stocks. As it would like trigger inflation fears and higher interest rates.

The current pace of economic growth, slowing inflation rates, and valuations suggest banks stocks are likely good bets to sell or short heading into 2019 with more downside risk than upside potential.

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.