Investors have worried about rising US inflation and rising interest rates since the start of 2018, but to this point, it has been more talk than reality, while the inflation we have seen is likely to disappear. In fact, as I have pointed out in the past, I continue to believe that inflation rates will stay low, and that will help to push yields lower, not higher.

When looking at CPI and PPI, there is plenty of evidence to suggest that most of the inflation we have seen in 2018 is related to the rise in oil prices. When looking at some of the other vital commodities, we find prices falling, not rising. Such as copper, gold, platinum, iron ore, milk, etc.

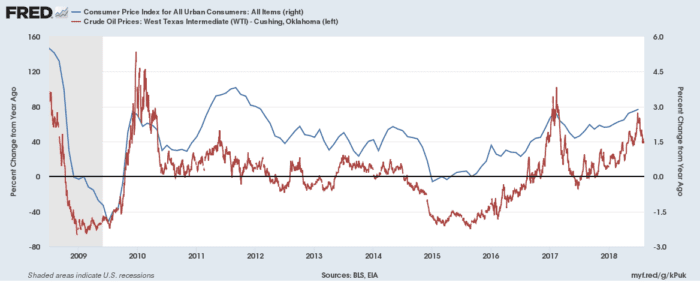

The chart below shows the tight correlation between the cost of WTI oil and the year-over-year changes in the CPI. With oil prices now starting to fall, one would expect that the recent rise in CPI, is likely to begin falling again.

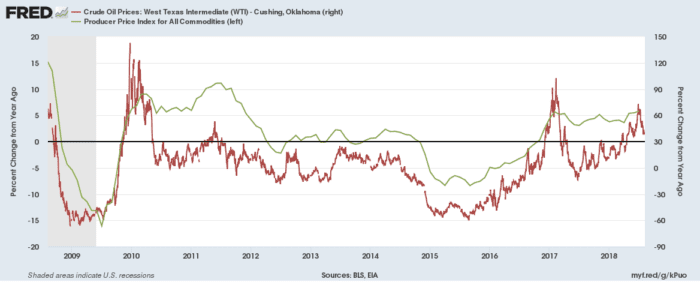

We can see the same relationship between the price of oil and the producer price index.

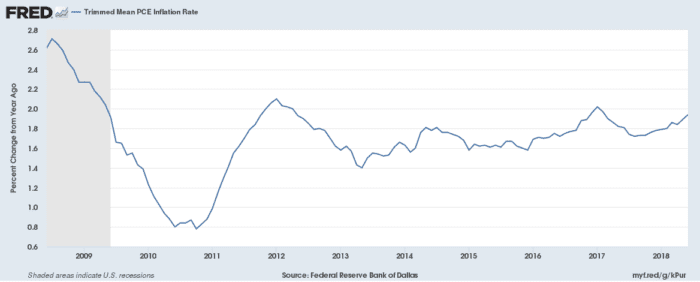

In fact, when we explore and look at the Trimmed mean PCE, we find that inflation through the end of June was up 1.94 year-over-year, barely at the Fed's target of 2%.

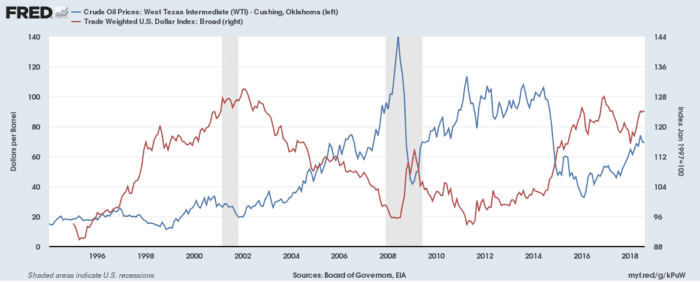

Additionally, oil prices are negatively correlated to the dollar, and should the dollar continue to strengthen, then the price of oil should start falling, acting as a negative force on inflation rates.

The above is just the first example of why inflation unlikely to return in 2018.

Broader Structural Issues

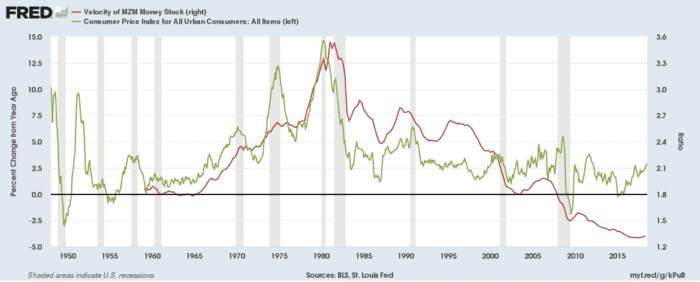

The second reason low inflation is likely to stay is broader and is the result of a structural issue within the economy. It finds its roots in the Velocity of MZM, the speed at which money changes hands in the economy. It turns out the Velocity of MZM has also been a good predictor of inflation. To this point, it too would suggest that inflation is anything but run away, and whatever bit of inflation we have seen is likely not to last, or at the very least remain constant, without a further rise.

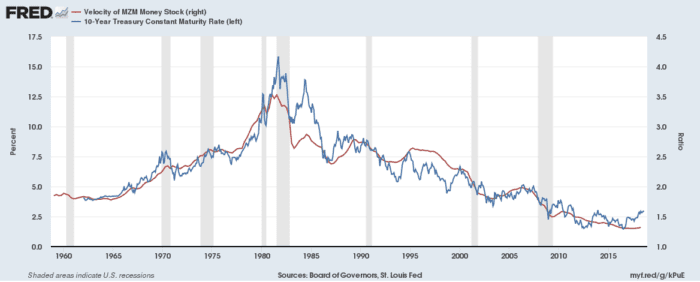

Even more interesting is that Velocity of MZM has been an incredible gauge for the future direction of long-term interest rates, on the 10-year Treasury. The Velocity of MZM has since the early 1980's as the pace of the MZM money supply creation has outpaced the rise in GDP. Velocity of MZM is merely the ratio of GDP divided by MZM total money supply.

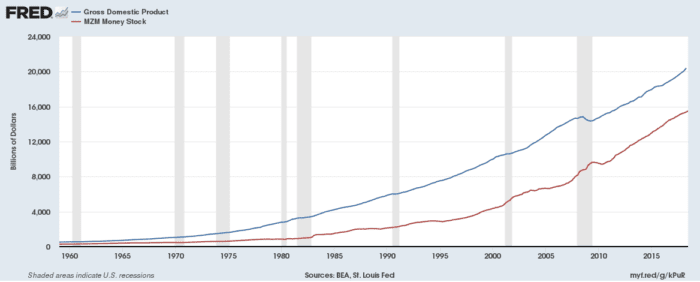

GDP growth has slowed materially over the past several years, but the MZM supply has increased; thus the pace for inflation has slowed. In the chart above,w e can consider that in the early 1980's $1 created in MZM created nearly $3.5 in GDP. Today, $1 generated in MZM creates just $1.3 in GDP. We can see in the chart below the MZM creation has outpaced GDP growth.

Just this year, 2018, we have first started to see GDP accelerate, and should GDP continue to grow and even outpace the growth of MZM, than in future years, we may begin to see a pick-up inflation. But will inflation suddenly re-emerge in 2018 or even the start of 2019? It seems unlikely, and that is good for stocks.

(This post originally appeared on Mott Capital's Monster Stock Market Commentary)