When you thought the outlook for stocks could not get any better, it did. According to the latest data from S&P Dow Jones Indices, operating earnings estimates continue to rise, the number of companies beating earnings estimates is at a six-year high, and revenue growth is strong. That means the stock market may be set to soar by 22%, sending the S&P 500 to 3,500.

Beating By A Wide Margin

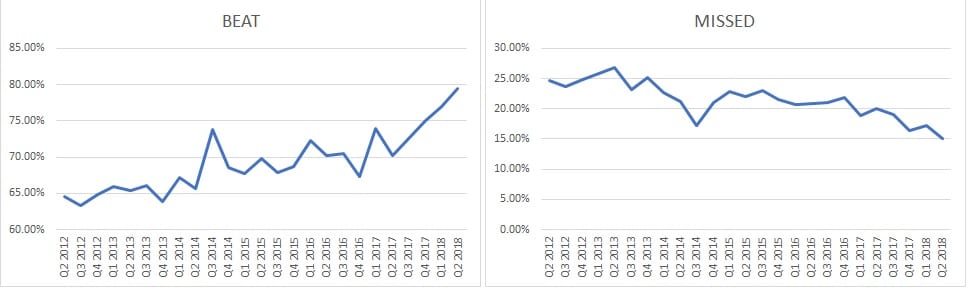

With more than 96% of the S&P 500 companies now finished reporting results, a stunning 80% of them beat their estimates, while 15% have missed. The number of companies beating estimates is at its highest level since 2012, while the number of companies missing is at the lowest level.

Strong Sales Growth

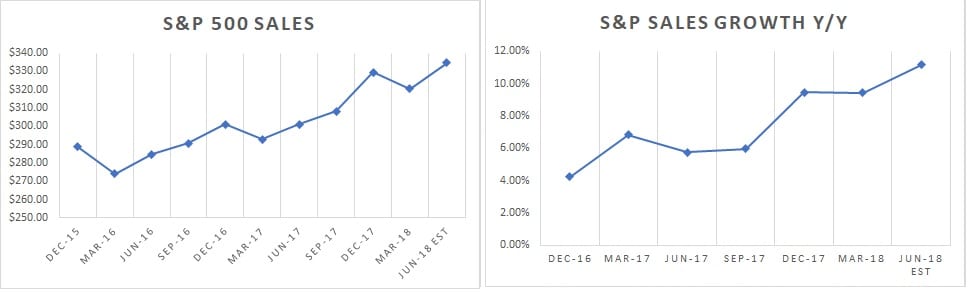

The better than expected earnings growth is coming on the strength of strong revenue. Sales growth has increased by more than 11 percent over the same time last year to $334.60 per share.

Estimates Revisions

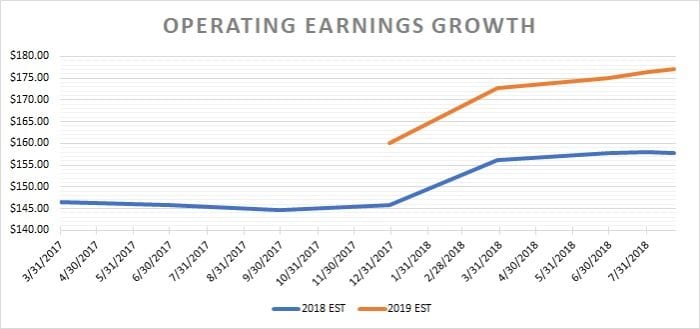

But better still, earnings estimates continue to increase, with operating earnings climbing to $177 per share as of August 23 for the year 2019. That is up 11 percent since the start of the year when estimates were for only $160.

Still Cheap

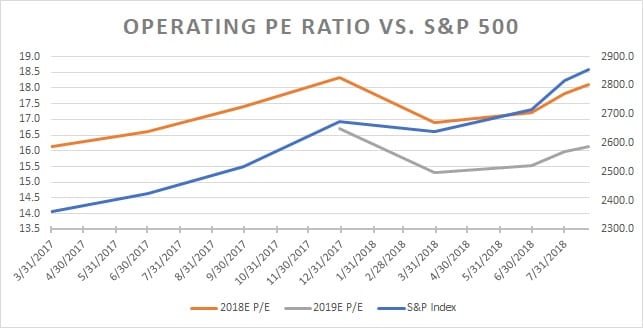

Because of the strong revision, stocks are cheaper today than at the start of the year with a 2019 operating PE ratio of 16.1. That is down from 16.7 on December 29. That is because earnings growth expectations have outpaced the S&P 500's rise of 7.5 percent.

Economic Growth

For now at least the outlook for the economy remains strong. Third-quarter GDPNow estimates are forecasting growth of 4.6%.

3,500?

So it possible for S&P 500 to climb to 3,500 within the next year? Consider if estimates remain consistent the operating PE would be less than 20 at 19.8. Seems plausible to me, that a 22 percent rise in the S&P 500 looks possible.

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future.

Disclosure:

I have no positions in any of the securities referenced in the contribution

I do not use any non-public, material information in this contribution

To the best of my knowledge, the views expressed in this contribution comply with UK law

I agree with the terms and conditions of ReachX

This contribution is for informational purpose and does not constitute investment advice nor is it an offer to sell or buy, nor is it a recommendation for any security.

Michael J. K.