Why interest rates matter?

The US Federal Open Market Committee (FOMC) was widely expected to increase the Fed Funds rate, which it did and this brings the focus of investors back to the subject of interest rates and the impacts it could have on the economy as a whole.

Interest rate is considered as the most widely used monetary policy tool by authorities to control the cost of money in order to have an impact on the broad based money supply.

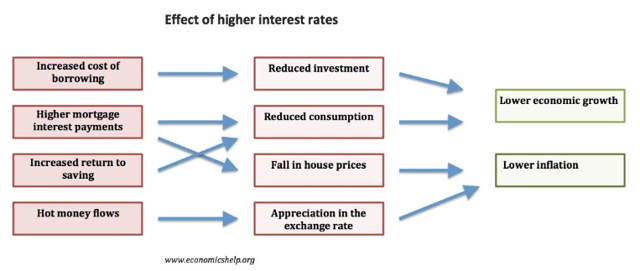

(Source – economicshelp)

Higher interest rates will increase the cost of money and will result in lower demand for credit. Eventually, credit growth should slowdown and the economy would begin to show signs of cooling down. A higher proportion of disposable income would be allocated to savings and this will lead to a decline in the core inflation rate via weakening demand-pull inflation effects.

Interest rates have risen over the past two years and is likely to rise further

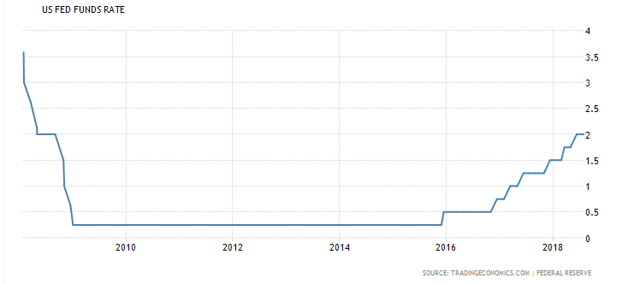

The Federal Reserve has increased interest rates gradually since 2015 and this was powered by an ever strengthening US economy. Economy of the United States has picked up from its lows of the Financial Crisis and is currently growing at record levels.

During the times of the financial crisis, the Fed lowered the benchmark interest rate (overnight borrowing rate of banks) close to zero to stimulate the economy. This decision was widely praised since it was able to boost the descending economic growth in America and businesses once again picked up driven by the increased availability of funds.

The Fed Funds rate remained below 0.5% from 2009 to 2015 and businesses in the United States prospered during the same time period.

Fed Funds rate

(Source – TradingEconomics)

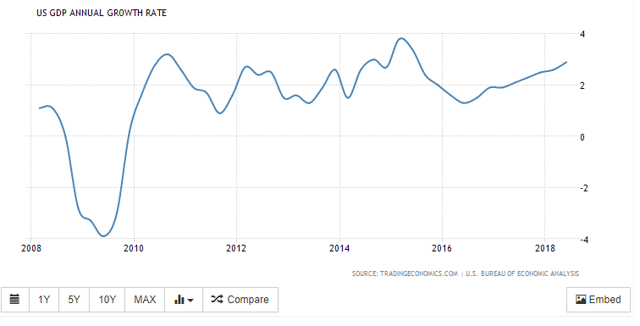

GDP growth rate in the United States once again picked up and by 2015, the economy was heating up and growing at stellar rates. At the moment, the U.S. GDP is growing at a record pace and is expected to grow in the foreseeable future as well.

Annual GDP growth rate in the United States of America

(Source – tradingeconomics)

The Federal Reserve targets to keep inflation at 2% which they believe would enable the economy to expand sustainably. However, the recent boost in economic activities have forced the Fed to increase rates over the past couple of years to keep inflation at or near the targeted level of 2%.

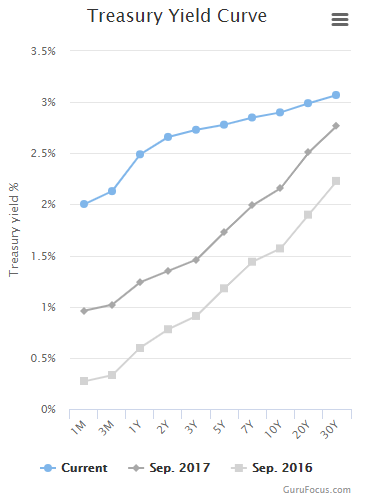

In line with increasing benchmark rates, the yield curve has positively shifted from where it was in 2016. A positive shift in the yield curve is proof of the increasing borrowing costs and this helps cool down the economy by controlling the money supply. During the remainder of my analysis, it would be apparent that the Fed is poised to increase rates further to achieve its inflation target.

Yield curve has shifted positively

(Source – GuruFocus)

The Fed is considering a few key economic indicators to decide whether a rate hike or a cut is required to keep the economy from unnecessarily heating up or cooling down.

Major indicators include;

- Inflation rate

- Unemployment rate

- Wage growth

Inflation rate in the United States was declining since early 2010 and was well below the Fed’s target of 2% leading up to 2015. However, the US economy was growing and disposable income was increasing. A spike in inflation was expected based on demand-pull inflation and the Fed had to intervene by way of increasing the Fed Funds rate to keep inflation in check.

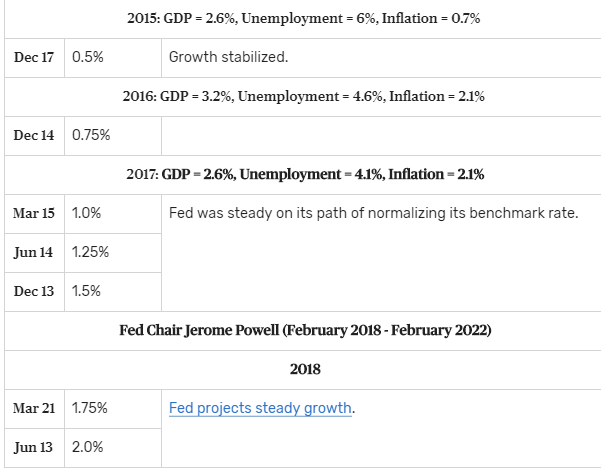

Since its first interest rate hike in 2015, the Fed has so far increased the benchmark rate 7 times but inflation has gradually increased and is currently above the Fed’s target of 2%.

Fed rate hikes since 2015

(Source – The Balance)

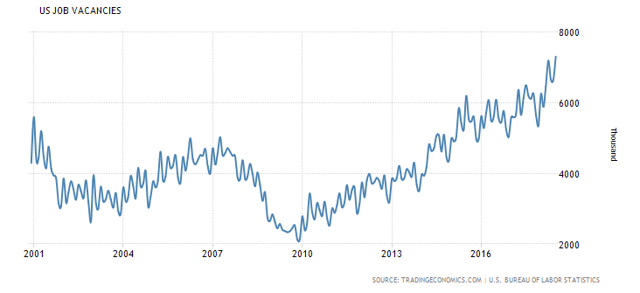

Unemployment rate on the other hand is at a record low. In line with the economic expansions that took place since the financial crisis in 2008, the demand for skilled labor has grown exponentially and is expanding further which can be observed by the increasing number of jobs added every month.

Unemployment rate in the US for the last 10 years

(Source – TradingEconomics)

Whilst the sharp decrease in the unemployment rate has prompted the Fed to increase the benchmark interest rate 7 times within the last couple of years, the continued decline of the unemployment rate will force the Fed to raise interest rates further.

Contributing to the declining unemployment rate is the increasing number of job vacancies available in the United States. To put this into perspective, the number of job vacancies available at present is at an all-time high.

(Source – TradingEconomics)

Declining unemployment rates and increasing job vacancies will almost always lead to a spike in wages, in which situation the inflation rate will start to ascend. This paves the way for the Fed to increase benchmark rates to keep inflation in check. Higher benchmark interest rates will have effects that would flow through the economy and corporates would be forced to abandon a portion of their expansion plans due to higher borrowing costs. This is expected to cool down the heating job market.

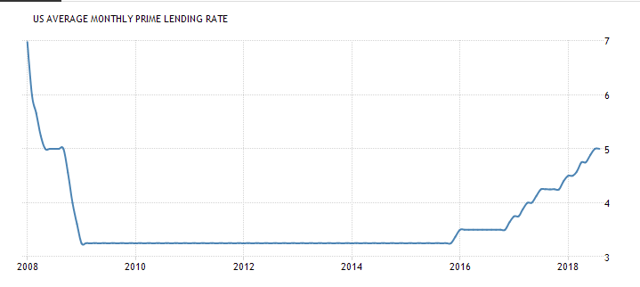

Borrowing costs are already on the way up and we can expect costs to be higher in the latter part of 2018 and in 2019.

Average prime monthly lending rate in the US

(Source – TradingEconomics)

Higher borrowing costs will surely have a reverberating effect on the US economy but currently, the rates are not at historically high levels and the recent corporate tax cuts have provided US corporates with an additional layer of cash to spend on expansion projects.

Rising interest rates and stock market performance

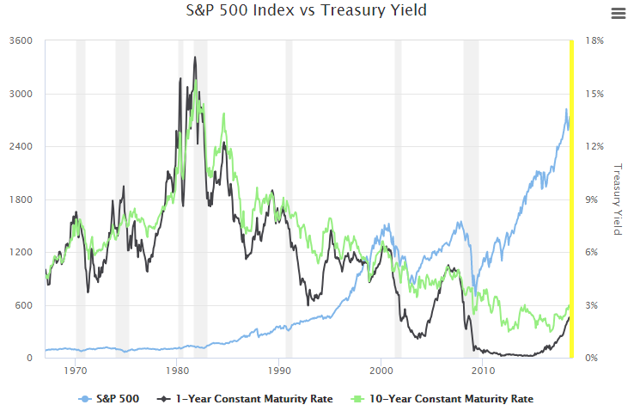

Interest rates and equity market performance theoretically has a negative correlation since higher interest rates prompt investors to allocate more funds to interest paying securities rather than to equities. The expected rate of return on equities tend to ascend under these circumstances since equity returns are expected to compensate for the higher opportunity cost of foregoing investments in fixed income securities that are high yielding.

The below graph depicts how the S&P 500 return has varied along with movements in the treasury yield. It is apparent how the S&P 500 return has negatively correlated with the treasury yield.

(Source – gurufocus)

Inverted yield curve as a predictor of future recessions

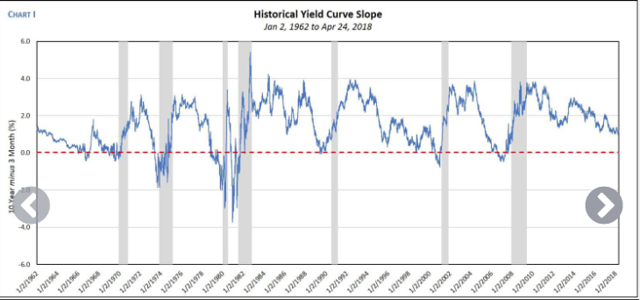

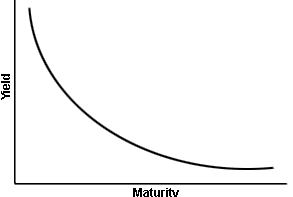

Inverted yield curve; an environment in which long-term debt instruments yield lower than short-term debt instruments of the same credit quality has been constantly identified as a predictor of economic recessions.

An illustration of an inverted yield curve

Generally, the yield curve is upward sloping since longer dated debt instruments are expected to have a higher yield in order to compensate for the time value of money. Historically, a yield curve inversion has occurred well before each of the last 7 economic recessions reported in the US.

Inverted yield curves and economic recessions

(Source – Think Advisor)

The grey color lines in the above chart indicate time periods of economic recessions in America. The yield curve has inverted (10 year yield minus 3 months yield turning negative) well before each economic recession.

When the yield curve inverts, it suggests that investors are of the opinion that the economy is in bad shape and heating up. It is worthwhile to look at the current state of the yield curve to determine whether there is a threat of a yield curve inversion.

Yield spread between the 10 year treasury yield and 2 year treasury yield

(Source – Federal Reserve Bank of ST. Louis)

Currently, the yield spread between the 10 year treasury yield and 2 year treasury yield is close to 0.25%. The lowest spread reported between these two yields during the last year is 0.18%, which was back in August.

Even though one might assume that the spread between these two treasuries are falling steadfastly and would soon be inverted, generally it takes years for such a gap to contract. However, it should be well observed that the yield curve is already flattening as the spread between long dated treasuries and short dated treasuries is falling.

Investment ideas

As interest rates rise, there are a few key industries to focus on.

- Banking and financial sector is expected to benefit the most in a rising interest rate environment as net interest margins widen. A point of concern however is a slowdown in credit growth. It should be further analysed whether a credit growth slowdown would occur at the current level of interest rates.

- Non-cyclical consumer staples sector would be least affected by rising rates since the demand for consumer staples is inelastic.

- Healthcare sector on the other hand looks promising and attractive as demand would not be hurt by rate hikes. Furthermore, countries across the globe are undergoing an ageing crisis but income levels are increasing. This will create a robust demand for healthcare products in the future.

Conclusion

The Fed Funds rate, which is the benchmark interest rate in the United States is expected to increase in gradually (one such hike would be in December) and the economy will show signs of cooling down. Keeping the core-inflation rate at a sustainable level is critical to the performance of this heating up American economy. Rising interest rates might do the trick by reducing consumer spending and promoting savings but when interest rates increase beyond the flux point, the economy would be hurt badly and economic activities might reduce drastically.

Even though there are no direct signs of an overheating economy, investors should be considerate and educate themselves on the effects of macro-economic dynamics including interest rate movements and their impacts to equity markets.

The US economy is in one of its best growth phases in the history but like always, there would be a point at which the economy would start to contract. Whilst continuing to invest in undervalued stock issues, focusing on the macro-economy will provide investors with an edge to beat markets.

In my opinion, equity market performance in the United States in the coming years will lag behind the performance figures reported in 2016, 2017 and 2018. However, I remain bullish on the US stock market but believe that winners would be investors who apply an additional layer of cautiousness prior to making investment decisions.

Disclosure:

I have no positions in any of the securities referenced in the contribution

I do not use any non-public, material information in this contribution

To the best of my knowledge, the views expressed in this contribution comply with UK law

I agree with the terms and conditions of ReachX

This contribution is for informational purpose and does not constitute investment advice nor is it an offer to sell or buy, nor is it a recommendation for any security.

Dilantha D.