Gold (NYSE: GLD) and Silver (NYSE: SLV) have been selling off strongly in recent weeks due to strength in the US dollar, driving them to 52-week lows. Here are five reasons why now may be a good time to buy:

1. Declining gold discoveries

The drop in gold prices off of recent highs has made it less economical to mine gold, resulting in both fewer mines as well shorter mine lifespans. This will inevitably lead to less gold production and possibly a supply crunch that would boost prices.

2. China and India

Asian giants India and China have been accumulating large amounts of the precious metal - driving up global demand as well as laying the groundwork for future challenges to the dollar as the world's reserve currency. Indian households traditionally invest a large portion of their savings in the precious metal and also love gold jewelry. As their nation's wealth increases, so does their aggregate demand for gold. Geopolitical and economic uncertainty in China is driving their heavy demand for the metal: namely, the possibilty of war, falling Yuan value, and declining property prices. If the current trade war prolongs and begins taking a heavy toll on the economy, a further flight to safety might be in order.

3. US fiscal and monetary policy

The US Federal Reserve's low interest rate policies have propped up an otherwise weak economy in the wake of the financial crisis while also facilitating record government budget deficits. While the current economic strength makes it likely that the Fed will raise rates from present levels, thereby suppressing precious metals prices, that expectation is already largely priced into the market. As US national, state, corporate, household, and student debts continue to soar to new highs, the central bank will feel continued pressure to keep rates low even as inflation continues rising, likely leading to continued negative real rates (interest rate minus inflation rate). Economic history showsthat negative real rates are a very bullish indicator for gold and silver.

In fact, Fed Chairman Jerome Powell acknowledged recently that inflation could head up to 2.5% without the Fed feeling the need to take extra countermeasures. The Core PCE Price Index is currently at 2.0% year over year, which, while above expectations and revealing an accelerating inflationary trend, still has plenty of room to run before meeting the Fed's target ceiling. Meanwhile, inflation is raging at an even higher rate according to other metrics, with one measure showing it actually at 2.9% in June, up 120 basis points since last July and at its highest level since 2012 (during the previous gold and silver bull market).

4. Geopolitics

With the ongoing tensions between the US and international rivals Russia, Iran, Syria, China, and North Korea, there are plenty of factors that could potentially combine to significantly disrupt the global economy at any time. The US could eventually play a more aggressive military role in Syria thereby putting it into direct confrontation with Russia, its sanctions on Iran could very likely lead to a major war in the Middle East, its trade wars with China, Canada, and Europe could eventually lead to global economic recession or even an actual war, and its relations with North Korea could turn south at any moment. History has proven that precious metals are second to none when it comes to safe haven assets in uncertain times.

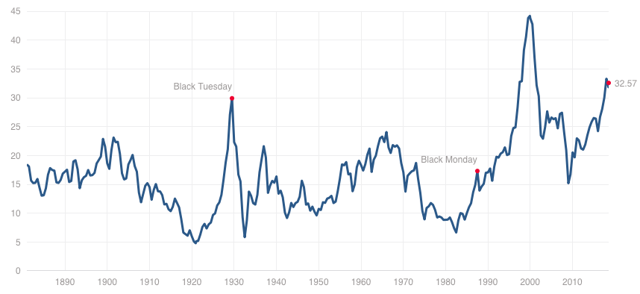

5. Gold and silver are at a decade low versus the stock market

As the chart below indicates, the price of gold versus. the value of the S&P 500 Index is around a 10-year low. This indicates that, given the previous factors listed, gold is an especially attractive investment right now relative to other available options.

Furthermore, even as its relative price has declined significantly, equity valuations have reached their second highest levels in modern history:

Investor Takeaway

While these fundamentals all imply that precious metals are undervalued, as recent history has shown us, the market can behave irrationally for considerable periods of time. While there are no guarantees of near-term profits in silver and gold, and in fact there very well may be further losses on the way, we can be certain that, given excessive government spending and continued artificially low interest rates, the US dollar will continue to lose purchasing power over the long term and will likely therefore lose value relative to silver. Furthermore, it is also important to remember that silver and gold are backed by thousands of years of history as stores of value, giving them the ultimate moat as the safest long-term investment (besides land, perhaps) possible.